One of the elements of my adult life that has traditionally been unstable is housing. Sure, I’ve always had a place to live and no, I’ve never wanted for a roof over my head. However, having stable housing was always something that evaded me no matter what situation I was in at the moment. I’ve rented a single room in a large boarding house and I’ve rented a room in a house with a group of fellow college graduates who were just out of school. I’ve rented apartments with two other roommates and I’ve rented a townhouse with one other roommate. The one aspect in all of these housing situations is that there was a time limit on how long I’d be living in any of those units because they were rentals. And, frankly, that time limit was exactly what my roommates and I wanted over the years. The limit gave each of us a chance to get out of a lease if we needed to and it also gave us a chance to negotiate better terms on an annual basis. Let me be clear – I have no complaints about my housing situation leading up to my decision to buy a house.

This isn’t the actual “sold” sign from my new townhouse, but you get the point

The common theme, though, was the unstable relationship between my finances and my housing situation. What I mean by this is that by not owning the different locations where I’ve lived over the years I was at the mercy of externalities that could (and did) have a direct impact on both my housing stability and my personal finances. For example, if one of my roommates decided to (or had to) leave in the middle of a lease, then their leaving would increase my monthly expenses by a factor based on how many other roommates I had at the time. In other words, an expense that should have been “fixed” in my personal budget was always at risk of increasing based on externalities that were outside of my control.

As a guy who works in finance and who is a maniacal manager of my personal finances, I don’t like it when I’m not in control of my long-term fixed costs and, by consequence, other financial stability-related issues.

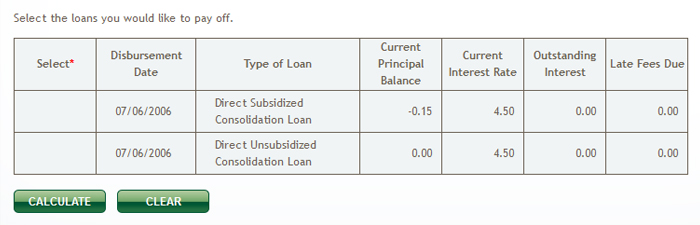

At the end of February 2014, my now-former roommate told me that he was finally hired by a group that he had been hoping to get a job with for the past few years. This was a tremendous success for him and a really good, positive moment. This was also a good moment for me because I had been searching the “for sale” listings for a few months at the time that this news came around. In a different scenario, I would have been at my wits’ end trying to find a way to piece together a new living situation. However, after paying off my student loans and feeling financially free since August 2013, I was ready to purchase a home.

The stability that I received in my personal finances from paying off those student loans was great. Yet, it also made it abundantly apparent that I needed to stop renting and buy a home sooner rather than later. Given the high cost of owning a home in New Jersey (if you’re reading this from a state other than New Jersey, you don’t want me to start going into our property taxes), it was always a smarter move for me to live with at least one roommate instead of buying a home of my own. Over the years, though, certain things change. One example of the things that changed is that I’ve gotten older over the years and with that age has come a certain rigidness in what I want in my home. I like what I like and don’t want to be bothered with whatever annoys me! When you live with a roommate, you have to share space and sometimes you can get annoyed by what your roommate does without even thinking about it. Maybe you don’t want to watch the same show on the television or maybe you don’t want to wait for your roommate to finish making breakfast/lunch/dinner so you can get into the kitchen to fix yourself some food. Perhaps you’re not a fan of the state that your roommate leaves the kitchen in when they’re done making their food. The list can go on and on.

This isn’t to say that I haven’t had a wonderful group of roommates over the years. Rather, this is all to reiterate the point that as you get older you change. And as I got older I slowly segregated myself from the entire townhouse that I lived in to just living out of my bedroom. Imagine a very dorm-like situation – I would wake up, shower, and prepare for work all in the same room. When I got home from work, I grabbed a bottle of water from the refrigerator and then headed to my room to catch up on the day’s news, do some work for my small businesses, and then eventually go to bed… just to perform a very similar routine the next day.

I won’t get too deep into the process of buying a house here, but suffice to say that I found a place nearby where I live now that I felt was priced right. I struck a deal with the owner for a few thousand less than the townhouse was on the market for and we’ve were out of attorney review quickly. The home inspection was done and came back stellar, the appraisal was completed and the value is right where I thought it would be and my mortgage company was lined up and ready to fund me. In the space of about a month, I was able to go through the entire searching and closing process. Not too bad.

For the few weeks that I worked through this process, I had a chance to consider how I want to arrange the 3 bedroom, 2.5 bath townhouse that I bought. I had a chance to consider what I want to do with the garage that is attached to it, what I want to do with the living room, dining room, and eat-in kitchen. I also had a chance to think about which family events I want to host on an annual basis and which events I want to host for my friends in the area. Another aspect that I considered is how I wanted to furnish the place and that’s another aspect of the townhouse that I thought about during the closing process. Luckily, my sister-in-law’s twin sister is an interior designer and she came in to help me choose colors, textures, furniture, and more!

Buying a house was a fun time and not such a bad idea. Plus, I now get to write these blog entries from the comfort of my personal home office – which is fully separate and apart from my bedroom and living space!