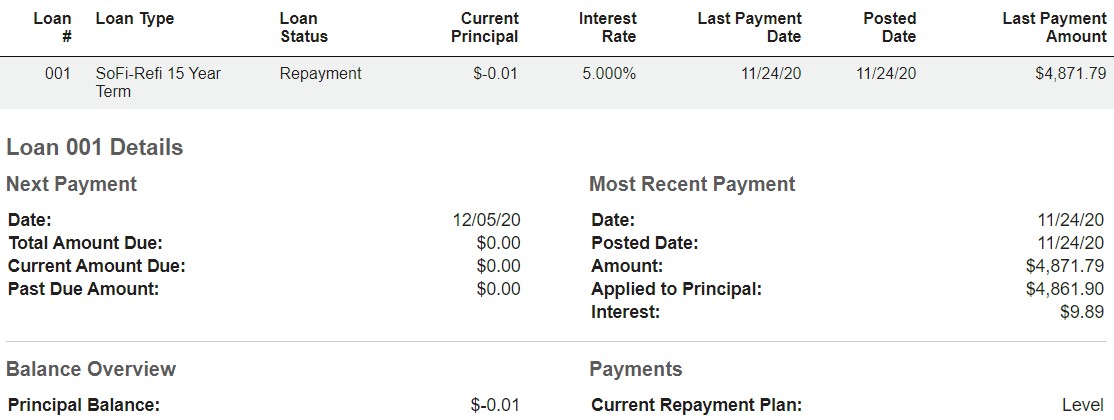

Several years ago, I posted an update showing what the screen looked like after I paid off my undergraduate and graduate student loans. It was great to finally see the “current balance” on those loans paid down to zero. As my Mother mentioned the other day, it gives you a real feeling of accomplishment having paid off a major student loan. And now, more than 7 years later, I am posting another screenshot of a zero balance, but this time for my doctoral student loans. Check it out:

My last student loan – for my doctorate – showing a zero balance

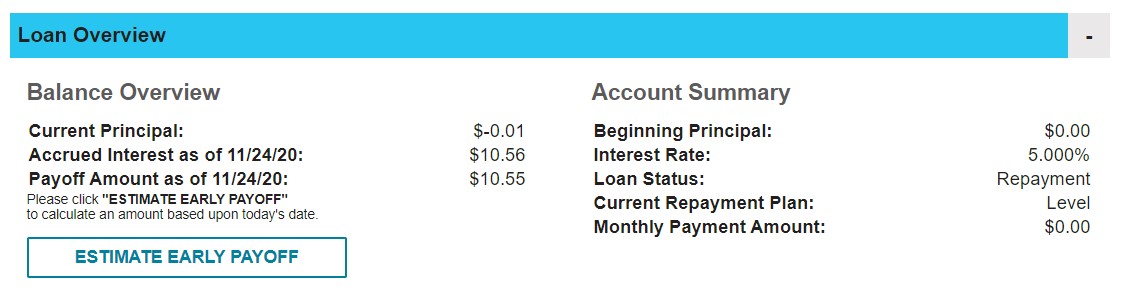

There you go, folks. That is what it looks like to no longer owe anything in student loans. Not only does it look pretty good, but it feels pretty good, too. Also, here is another screenshot from another part of the student loan website showing the zero balance. Check it out:

My student loans are fully repaid – all of them

As I mentioned the other day, I plan on writing more about student loans from time to time, but I just do not have much more to write about my own repayment journey because it is now, completely, over.

I repaid $244,826.91 in undergraduate, master’s, and doctoral student loans. The debt was comprised of $193,430.16 in loan principal, $14,313.42 in capitalized interest, $2,146.59 in closing and refinancing fees, and $34,936.74 in interest. My lenders included the United States Department of Education’s (USED) Perkins loan program, their subsidized and unsubsidized Direct Loan programs, the New Jersey Higher Education Student Assistance Authority’s NJCLASS program, CitiBank, and SoFi. You can read my entire student loan repayment story on JerseySmarts.com.

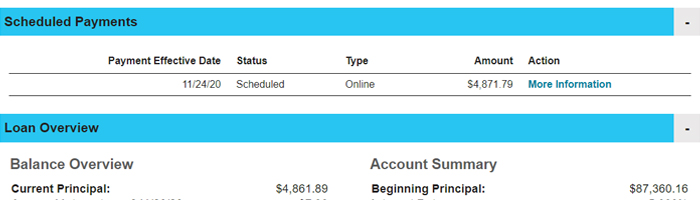

Just in terms of raw numbers, when I started repaying my doctoral student loan in December 2018, I owed $89,286.86. Today, I owe $49,301.17, though I just made a $17,000 payment so my loan balance will drop after that payment is applied. And there you have it – that is the big difference between me paying back a student loan in the year 2020 and me working like a madman to pay back my student loans 10+ years ago. Today, with a lot of experience and seasoning under my belt, I am a highly educated professional who earns a respectable living and who has curated several sources of income. It was easy to set up a strategy to pay back the new student loan at this point in my life because I have worked diligently to be a position to not have major financial obligations like this become life-defining. In fact, I plan to have the rest of this student loan paid in full by early December of this year. That would not have been possible during my first time around paying back my loans.

Just in terms of raw numbers, when I started repaying my doctoral student loan in December 2018, I owed $89,286.86. Today, I owe $49,301.17, though I just made a $17,000 payment so my loan balance will drop after that payment is applied. And there you have it – that is the big difference between me paying back a student loan in the year 2020 and me working like a madman to pay back my student loans 10+ years ago. Today, with a lot of experience and seasoning under my belt, I am a highly educated professional who earns a respectable living and who has curated several sources of income. It was easy to set up a strategy to pay back the new student loan at this point in my life because I have worked diligently to be a position to not have major financial obligations like this become life-defining. In fact, I plan to have the rest of this student loan paid in full by early December of this year. That would not have been possible during my first time around paying back my loans.