Back, once again, with another Start the Weekend Right Link Series. I hope that the links in this week’s offering give you some fun articles to read to get your weekend started right. And I know that there are more people out there reading these updates today than a few weeks ago and I have heard your feedback, so I am going to try to include some more contemporary links each week, too. I continue to recommend using Feedly as an RSS reader (and, again, I am not getting any payment for recommending this product – I just really like it as a replacement for the old Google Reader). If you already have a Feedly account, then you can follow my blog by clicking here.

And we can start this week with a link to an article posted just a few days ago! Mark’s Daily Apple is a great resource for those individuals looking to learn more about the paleo lifestyle, what it means to eat like a caveman, and what it means to be healthy for life. Some 9 years ago, I read and loved this website’s book called The Primal Blueprint. This article is an expansion of some of the great ideas that are in that book.

Why I Stopped Journaling, Art of Manliness

This is one of the articles where I might not completely align to the takeaway points. Last month, the author wrote a great entry talking about how they stopped journaling because they did not have any big decisions to make, they got better at managing their emotions, and they have friends now. For some, journaling helps in all of those aspects of someone’s life. For me, daily journaling is a stress reliever and a way to get my thoughts out of my head with a paper and pencil.

Why Ed Schools Are Useless, Minding the Campus

I have a doctorate from an education school where I loved the experience, and before I obtained that doctorate, I earned a post-master’s certificate from another educational school where I loved the experience. The argument in this article from 2013 says that education schools have “very little rigor and no incentives to excel academically” and they use some data to back that perspective. My instinct tells me that this is probably a case-by-case basis.

Joe Biden’s student-loan forgiveness…, Condemned to DEBT

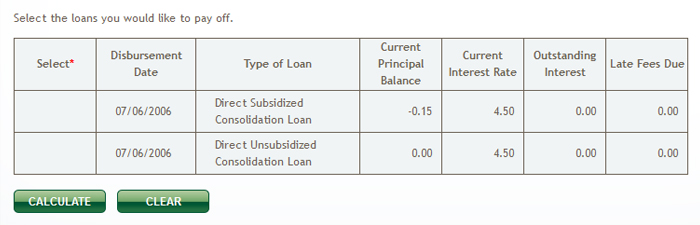

Back in April, the very good Condemned to DEBT blog provided a brief analysis of Vice President Joe Biden’s student loan plan. If you are a student loan wonk like I am (I mean, I have been one of their bigger individual customers), then this is something that you want to read. However, based on what I read at this link, I was not that impressed with the plan. Admittedly, I’m usually not impressed with anyone’s plan for student loans.

The 10 Best Top 100 Books Lists, Book Riot

There’s nothing newsworthy in this link – it is being included here purely for entertainment purposes! This link will take you to a list of the top 10, top 100 books of the year lists. Again, the top 10 lists of the top 100 books… for the year 2013. This is one of the outcomes from keeping so many links bookmarked for so long of a period of time – I wind up with 7 year old links to lists of lists! I’m probably entertaining myself far more writing this than you are reading it!

Have you come across any great articles lately? If so, then please share those links in the comments below. And one more time for those of you who love reading online articles, I strongly recommend using Feedly as an RSS reader. You can follow JerseySmarts.com on Feedly or you can add us to your existing RSS aggregator. Enjoy!