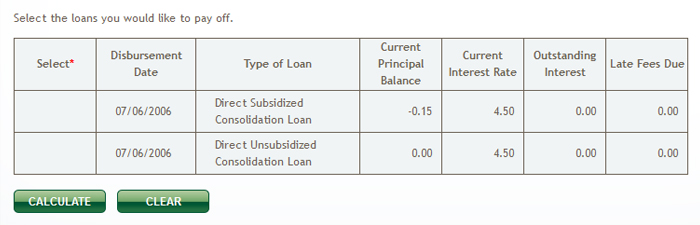

Thank you all so much for the kind words and praise that you’ve sent me via text messages, Facebook comments, Facebook messages, e-mails, discussions on your blogs, and phone calls over the last few days. Since I posted that my student loans were officially repaid, I’ve been reminded what a great group of people that I’m lucky enough to call my family and friends (both old and new). During the online celebration, some of you asked whether I had official confirmation on my payment being received and processed by the student loan company. On Monday, the answer was “no” because it takes a few days for the payment to show up on MOHELA’s website. However, today I’m proud to share the screenshot of the zero balance due on my loan. Take a look:

And that’s the end of my student loans.

And not only is there nothing due on the loan, but it looks like MOHELA actually owes me 15 cents! Ha ha!

In July 2006 I began repaying $120,603.31 in student loan debt. This debt was comprised of $106,070.00 in loan principal, $12,434.58 in capitalized interest, and $2,098.73 in closing and refinancing fees. I made the final payment on this debt in August 2013. My lenders included the United States Department of Education’s (USED) Perkins loan program, the USED’s subsidized and unsubsidized Direct Loan programs, the New Jersey Higher Education Student Assistance Authority’s NJCLASS program, CitiBank, and the Missouri Higher Education Loan Authority (the USED sold my loan to MOHELA in April 2012). In total, I paid $149,455.12 to these lenders including $120,603.31 in consolidated principal and $28,851.81 in interest. You can read my entire student loan repayment story on JerseySmarts.com.